Table of Contents

What and where is Ireland?

When people think of Ireland, they often lump it in with England—or just call it part of the United Kingdom. But while Ireland and the UK share a language and sit side by side on the map, that’s pretty much where the similarities end.

Let’s clear up a common source of confusion first: the island of Ireland is actually divided into two parts. Since 1921, you’ve had Northern Ireland in the north, which is still part of the UK, and the Republic of Ireland in the south, which is a completely separate, independent country. That split came about through the Government of Ireland Act in 1920, which originally aimed to create two self-governing regions under the UK umbrella. It even included a vision of possible reunification someday.

Fast forward to today, and these two areas run on different systems. The Republic of Ireland—Éire, as it’s also known—has its own government, its own laws, and yes, its own tax system. Meanwhile, Northern Ireland follows UK rules and policies.

If you need a mental picture, imagine the island of Corsica was split in two: the north still belongs to France, but the south runs independently with its own policies and economy.

And the differences don’t stop there. Ireland uses the euro, while the UK sticks with its iconic pound sterling. And while beautiful, Ireland does tend to be a bit pricier—living costs are around 10 to 15 % higher than in the UK.

So, why focus on Ireland now?

Well, it’s a country full of surprises. It might not always be in the spotlight, but it’s quietly climbing the ranks. In fact, in 2023, Ireland was ranked fourth in the world in the IMD World Competitiveness Yearbook—a huge nod to its global strength.

Here at BanTheTax, we’re all about helping you understand how places around the world can benefit your financial and tax wellbeing. So, let’s jump into what makes Ireland such an attractive option in 2025—especially when it comes to taxes.

Benefitting from the Ireland’s tax system means that you become a tax resident. And, as a tax resident, you can take advantage of the “non-dom” status offered here too.

So, what is “residence” and “domicile” in the Irish concept? We explain all this in this article.

Residence

Your tax residence refers to the number of days that you have been present in Ireland.

If you spend over 183 days during a calendar year, you will be treated as an Irish tax resident for that year.

In addition, if you spend an aggregated 280 days in Ireland over two calendar years, you will be treated as tax resident in the second year (provided you spent at least 30 days in Ireland during both years).

Tax domicile

If you are resident in Ireland but non-domiciled, you can benefit from significant tax exemptions on your foreign income under Ireland’s tax regime. And it is still valid in 2025.

Essentially, while you are liable for Irish tax on income and gains sourced in Ireland, any foreign income and gains you earn outside of Ireland are only subject to Irish tax if you remit (bring) them into the country.

This is known as the remittance basis of taxation. As long as you do not bring your foreign income or gains into Ireland, they remain untaxed in Ireland.

Importantly, there is no annual charge for claiming the remittance basis, unlike in some other jurisdictions.

To fully benefit, you should carefully manage your accounts to avoid mixing Irish and foreign funds, and seek professional advice to ensure compliance with relevant rules and anti-avoidance provisions.

BanTheTax can help you here; contact us if you need.

Does Ireland offer a "non-dom" tax regime?

Yes. As explained in the previous paragraphs, Ireland offers a favorable non-domicile (non-dom) tax regime similar to what the UK had before April 2025. If you’re tax resident but non-domiciled in Ireland, you can benefit from the remittance basis of taxation:

- Foreign income and gains are not taxed in Ireland unless you bring (remit) them into the country.

- There is no cap on the amount you can keep abroad and no time limit on deferring remittance.

- Funds earned before becoming an Irish tax resident can be brought into Ireland tax-free.

How to Benefit from Ireland's Remittance Basis in 2025?

There is no particular “application” for this regime. Concretely, you must use your Tax Return (Form 11).

In this form, there is no specific box to “apply” for the non-dom status — the Revenue assesses it based on your residency, domicile status, and remittance pattern.

You report your Irish-source income and any remitted foreign income on your annual tax return (Form 11, usually via Revenue Online Service – ROS).

Unremitted foreign income and gains are not reported, as they are not taxable under the remittance basis.

To make the most of this tax exemption:

- Keep foreign and Irish funds separate. Use clearly structured bank accounts to avoid accidentally triggering tax through mixed remittances.

- There is no annual charge to claim the remittance basis, unlike the UK’s former system which imposed fees.

- Be aware of Capital Acquisitions Tax (CAT):

- Gifts and inheritances are subject to 33% CAT.

- Non-domiciled individuals become liable for CAT after five consecutive years of Irish tax residency, with taxation starting in the sixth year.

The tax rates applicable in 2025

Watch our detailed video

Starting with personal taxes...

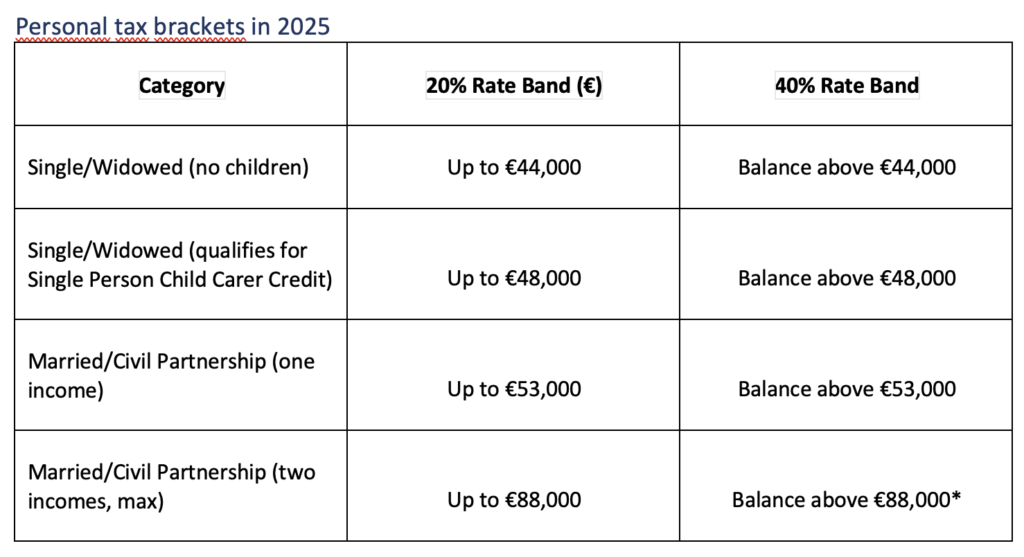

This year, some really positive changes came into effect. The standard income tax band was increased, from 42,000 to 44,000 euro. What does that mean for you? Well, it means more of your income is taxed at the lower 20% rate. That’s a real benefit, especially if you’re in the middle-income range.

(see income tax table further below)

And there’s more—personal tax credits like the personal credit, employee credit, and earned income credit have each gone up by €125, now sitting at two thousand euro apiece. That effectively raises your tax-free income.

Plus, the Universal Social Charge—that’s the USC—has seen a cut from 4% to 3% on income up to €70,044 . Another helpful reduction in your overall tax burden.

And here’s a big one—if you earn under €20,000/year, you won’t pay any income tax at all. You’re outside the income tax net. It’s a bit like the system in Cyprus, where income up to €19,500 is tax-free.

*The €88,000 band is only available if both spouses/civil partners work, and the increase is limited to the lower of €35,000 or the second income. If claiming the Home Carer Credit, the maximum is €53,000

Now let’s turn to business

Ireland continues to shine when it comes to company taxes. The corporate tax rate is still just 12.5% —one of the lowest in the entire European Union, together with Cyprus, Hungary, Poland, or Bulgaria. It’s no wonder multinational corporations love it here.

If your income comes from patents or intellectual property, you’ll enjoy an even better rate—just 6.25% . That’s a serious incentive for innovation and tech-based businesses.

Ireland also rewards companies that invest in research. There’s a 25% tax credit for research and development, and yes, even if your company is still making losses, you can claim it.

And with tax treaties in place with over seventy countries, international businesses benefit from reduced withholding taxes and far less risk of getting taxed twice on the same income.

Summarized Personal Tax Rates and Thresholds for 2025

- 20% on income above €20,000

- 40% on income above €44,000

You must also take into account your marital status and whether there is only one income or more, as follows:

- Married couple with one income: €53,000 at 20%; balance at 40%

- Married couple with two incomes: Up to €88,000 at 20%, depending on the income of the lower earner; balance at 40%

Does Ireland compete with the UK as taxation is concerned?

The answer is Yes! And here are the main reasons why you would choose Ireland over the UK :

- Lower corporate tax (12.5% vs 25%)

- Generous R&D incentives

- Broader low-rate tax bands for individuals

- Exempted income up to €20,000 (vs 12,500£)

- Lower effective tax rates for middle-income earners

- Access to the EU single market

- Tax treaties with 70+ countries

- IP and innovation-friendly tax schemes

Let’s split these incentives into personal and business taxations:

1. Personal : More tax-free income in Ireland:

In 2025, Ireland allows individuals to earn up to €20,000 completely tax-free, which is similar to the UK’s personal allowance (around £12,570), but Ireland also offers:

- Higher personal tax credits that directly reduce your tax bill.

- Expanded standard rate bands, so more of your income is taxed at the lower 20% rate (vs. 20%/40% in UK).

- Reduced USC (Universal Social Charge), making your effective tax rate lower for middle incomes.

- Social security differences (PRSI vs. NI):

Ireland’s PRSI contributions can be lighter, especially for self-employed individuals or directors, and some expats qualify for social security exemptions under EU or bilateral agreements.

2. Business:

· Ireland’s 12.5% corporate tax rate is world-famous—and lower than the UK’s 25% for profits over £50k. This is especially attractive for:

o SMEs and startups seeking tax relief.

o Holding companies with international operations.

· IP & R&D incentives:

o 6.25% Knowledge Development Box rate for income from patents or software IP.

o 25% R&D tax credit, even for loss-making companies.

· Currency and international lifestyle:

If you earn or spend in euros, living in the eurozone (Ireland) may offer advantages in stability or convenience.

o Access to EU markets + tax treaties:

Ireland provides frictionless access to the EU with 70+ tax treaties, while also maintaining a business-friendly, English-speaking environment.

Conclusion

Ireland’s combination of low corporate taxes, generous R&D incentives, increasing personal tax credits, and adjusted USC rates makes it a highly attractive jurisdiction for individuals and businesses in 2025. The tax system balances competitiveness with social support, encouraging both professional growth and personal financial efficiency.

Other incredible tax incentives for startups and SMEs make Ireland more than attractive in 2025. But we will cover this particular section in our next article soon.

We hope this article has provided some clarity about your Ireland residency and business options in 2025.

If you’re exploring ways to minimize your tax burden in any way (income, investment, business setups, …), BanTheTax is here to guide you.

Send us an email at info@banthetax.com.

We are eager to hear from you!

Thank you for subscribing to our Newsletter and to our Youtube channel! We appreciate your support.